City paycheck calculator

Switch to North Carolina hourly calculator. In addition to the state tax St.

Here S How Much Money You Take Home From A 75 000 Salary

Exempt means the employee does not receive overtime pay.

. Kansas City and St. Cities and counties do not impose this tax but some do affecting approximately 10. The PaycheckCity salary calculator will do the calculating for you.

Overview of Alabama Taxes. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. This number is the gross pay per pay period.

The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

For starters all Pennsylvania employers will withhold federal and state income taxes from your paychecks as well as FICA taxes. You rest assured knowing that all tax calculations are accurate and up to date. Calculate your North Carolina net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free North Carolina paycheck calculator.

Louis and Kansas City both collect their own earning taxes of 1. Whether thats a mortgage or rent a large percentage of your salary. The calculations are even tougher in a state like Ohio where there are state and often local income taxes on top of the federal tax withholding.

Switch to Maryland salary calculator. Learn what to do if your paycheck is lost stolen or damaged. What PaycheckCity Does What You Do.

You can also save for retirement while reducing your taxable income by putting more money into pre-tax retirement accounts like a 401k or 403b. Enroll in Direct Deposit. Calculate your Texas net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Texas paycheck calculator.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Subtract any deductions and payroll taxes from the gross pay to get net pay. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Calculate your South Carolina net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free South Carolina paycheck calculator. If you live or work in these cities you have to. Our paycheck calculator will help you determine how much more you should withhold.

Louis are the two Missouri cities that levy a local income tax and the rate is 1 in both places. They are the only cities in Missouri that collect their own income taxes. Calculate your Michigan net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Michigan paycheck calculator.

Calculate your Arizona net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Arizona paycheck calculator. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Check out the Frequently Asked Questions about pay.

It can also be used to help fill steps 3 and 4 of a W-4 form. To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option. Switch to Michigan hourly calculator.

Dont want to calculate this by hand. Residents and anyone who works in either city must pay this tax. Switch to Arizona hourly calculator.

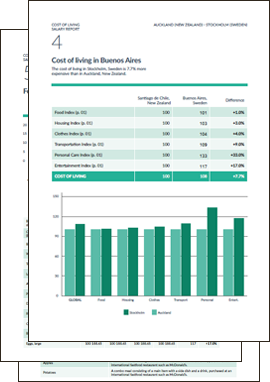

Simply decide how much you want withheld - for example 20 per paycheck - and write that amount down on a new W-4. Switch to South Carolina hourly calculator. The MoneyGeek calculator allows you to run cost of living comparisons of expenses in nearly 500 US.

This Missouri hourly paycheck calculator is perfect for those who are paid on an hourly basis. Although this is sometimes conflated as a personal income tax rate. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Get the latest financial news headlines and analysis from CBS MoneyWatch. Switch to Connecticut hourly calculator. Sales taxes are another important source of revenue for state and local governments in.

Learn about the benefits of this safe and fast way of getting your pay directly on your bank account. Calculate your Nebraska net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Nebraska paycheck calculator. Without the help of a paycheck calculator its tricky to figure out what your take-home pay will be after taxes and other monies are withheld.

Switch to Texas hourly calculator. The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay. Switch to Missouri salary calculator.

Then enter the employees gross salary amount. Calculate your Connecticut net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Connecticut paycheck calculator. To build it MoneyGeek combined data from the Council for Community and Economic Researchs Cost of Living Index employment data from the US.

This Maryland hourly paycheck calculator is perfect for those who are paid on an hourly basis. Switch to Nebraska hourly calculator. PaycheckCity calculates all taxes including federal state and local tax for each employee.

Find the banks that offer free checking. Bureau of Labor Statistics and demographic data from the US. Because there is only one US.

Calculating your paychecks is tough to do without a paycheck calculator because your employer withholds multiple taxes from your pay. Bureau of Labor Statistics the largest bill consumers pay each month is for housing. According to the US.

Gross Pay And Net Pay What S The Difference Paycheckcity

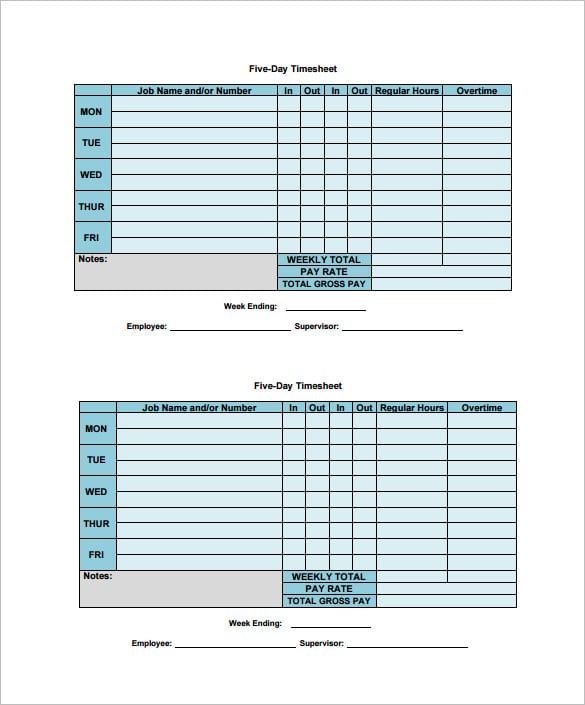

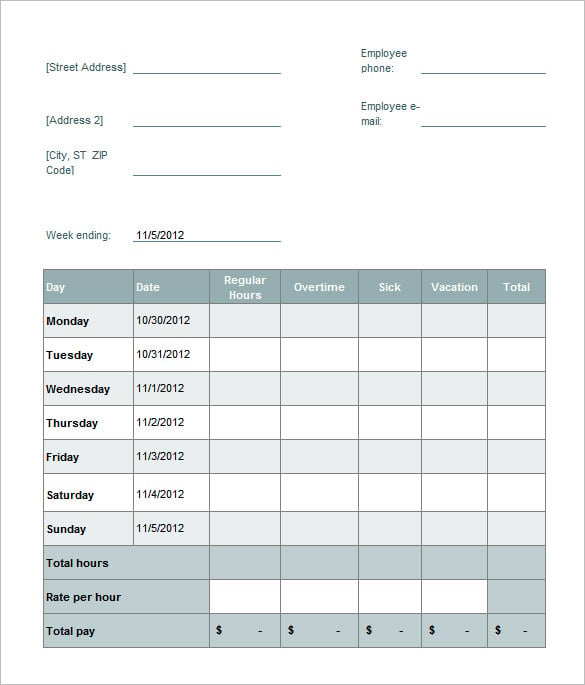

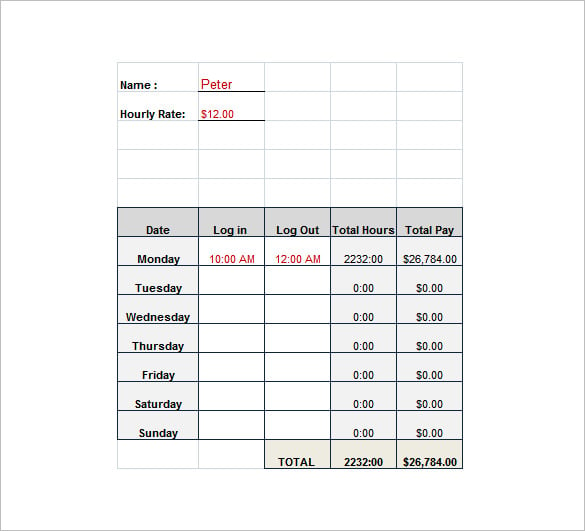

Payroll Calculator Free Employee Payroll Template For Excel

Salary Paycheck Calculator How Do You Calculate Your Take Home Pay Marca

Compare Salaries In Cities Teleport Eightball

Equivalent Salary Calculator By City Neil Kakkar

Paycheck Calculator Take Home Pay Calculator

Payroll Calculator Free Employee Payroll Template For Excel

Paycheck Calculator Take Home Pay Calculator

Here S How Much Money You Take Home From A 75 000 Salary

Payroll Calculator Free Employee Payroll Template For Excel

7 Weekly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Gross Pay And Net Pay What S The Difference Paycheckcity

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

7 Weekly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Hourly To Salary Calculator

International Salary Calculator Calculate The Salary You Will Need

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp